If you’re feeling overwhelmed by multiple debts, you’re not alone. Millions struggle with credit card balances, student loans, personal loans, and more. Managing these debts and figuring out the best way to pay them off can feel daunting. Fortunately, two popular repayment strategies—Debt Snowball and Debt Avalanche—offer structured ways to tackle your debt and regain control of your finances.

But which one is better? This detailed guide breaks down both methods, compares their pros and cons, and helps you decide which repayment strategy suits your financial situation best.

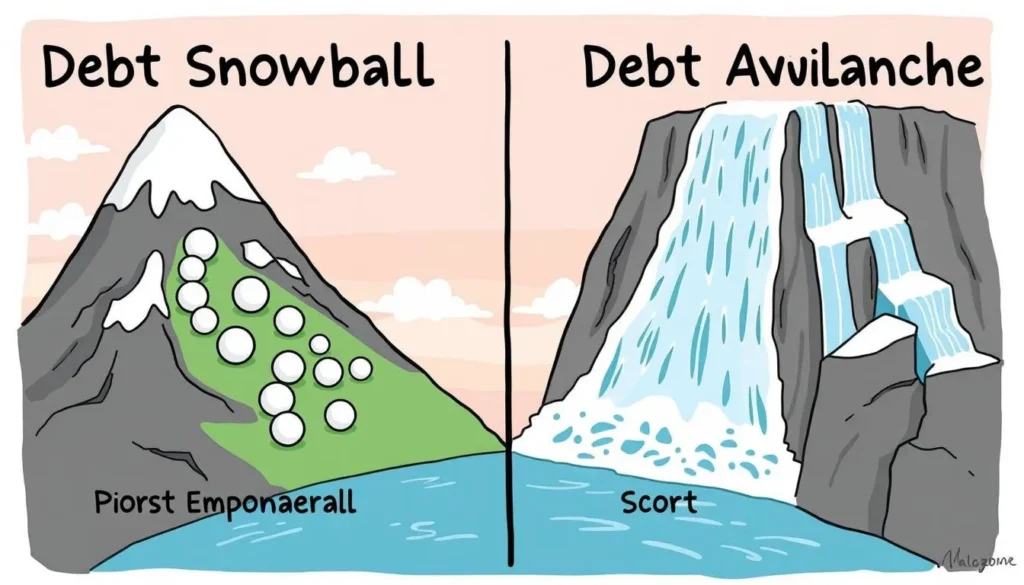

What Is the Debt Snowball Method?

The Debt Snowball Method is a debt repayment strategy popularized by financial expert Dave Ramsey. It focuses on paying off debts starting from the smallest balance to the largest, regardless of interest rate.

How Debt Snowball Works:

- List all your debts from smallest to largest balance.

- Continue making minimum payments on all debts except the smallest.

- Put every extra dollar toward paying off the smallest debt first.

- Once the smallest debt is paid off, move to the next smallest debt with the combined payment amount.

- Repeat until all debts are paid off.

Example:

- Credit Card 1: $500 balance

- Personal Loan: $1,500 balance

- Credit Card 2: $3,000 balance

You pay off the $500 credit card first, then move to the $1,500 loan, and finally the $3,000 balance.

What Is the Debt Avalanche Method?

The Debt Avalanche Method prioritizes paying off debts with the highest interest rate first to minimize the overall interest paid.

How Debt Avalanche Works:

- List your debts by interest rate, highest to lowest.

- Make minimum payments on all debts except the one with the highest interest rate.

- Put every extra dollar toward paying off the debt with the highest interest.

- Once the highest-interest debt is paid off, move to the next highest interest rate debt.

- Continue until all debts are paid.

Example:

- Credit Card 1: 22% APR, $3,000 balance

- Personal Loan: 15% APR, $1,500 balance

- Credit Card 2: 10% APR, $500 balance

You focus on paying off the 22% APR card first, then the 15% loan, and lastly the 10% APR card.

Debt Snowball vs. Debt Avalanche: Key Differences

| Feature | Debt Snowball | Debt Avalanche |

|---|---|---|

| Focus | Smallest debt balance first | Highest interest rate first |

| Psychological Impact | Provides quick wins and motivation | Focuses on saving money over time |

| Interest Paid | Usually more overall interest | Minimizes total interest paid |

| Repayment Time | May take longer to finish debts | Usually faster payoff |

| Complexity | Simple and easy to follow | Requires tracking interest rates |

Pros and Cons of the Debt Snowball Method

Pros

- Psychological boost: Paying off small debts quickly offers a sense of accomplishment and motivation to keep going.

- Simple and straightforward: Easy to understand and implement.

- Builds momentum: Early wins can increase confidence and commitment.

- Ideal for emotional spenders: Helps keep motivation high by showing visible progress.

Cons

- Potentially higher interest costs: Paying off low-interest debts first can cost more in the long run.

- Slower overall repayment: May take longer to become debt-free compared to avalanche.

- Not interest rate optimized: Could pay more to creditors.

Pros and Cons of the Debt Avalanche Method

Pros

- Saves money on interest: Prioritizing high-interest debts reduces total interest paid.

- Faster debt payoff: Typically leads to quicker elimination of debt.

- Financially efficient: Maximizes every dollar paid toward reducing debt principal.

- Good for financially disciplined: Suitable if motivation comes from financial logic.

Cons

- Delayed gratification: Paying off high-interest but large debts first may feel discouraging.

- More complex tracking: Requires keeping tabs on interest rates and balances.

- Motivation can wane: No early wins might cause some to lose momentum.

Which Method Is Better? Factors to Consider

1. Your Personality and Motivation

- If you need quick wins to stay motivated: Debt Snowball might be better. Clearing small debts quickly provides psychological benefits that keep you engaged.

- If you are disciplined and focused on minimizing costs: Debt Avalanche is usually the smarter choice, saving money on interest and paying off debt faster.

2. Size and Number of Debts

- Multiple small debts: Debt Snowball helps you knock out several small balances quickly.

- Few large debts with varying interest rates: Debt Avalanche can save significant interest.

3. Interest Rates

- If you have some debts with extremely high interest rates (e.g., credit cards above 20%), Avalanche method helps reduce the debt burden faster.

- If your debts have similar rates, the difference between methods is less significant.

4. Your Financial Situation

- If you are struggling to stay motivated or have a history of abandoning plans, the Debt Snowball method may increase your likelihood of sticking with repayment.

- If you’re confident in your ability to stay disciplined, the Debt Avalanche method will save you money.

How Much Can You Save with the Debt Avalanche?

To illustrate, suppose you owe:

- Credit Card 1: $5,000 at 22% APR

- Credit Card 2: $3,000 at 18% APR

- Personal Loan: $2,000 at 8% APR

You have $1,000 per month to pay off debts.

- Using Debt Snowball, you pay off the $2,000 loan first, then $3,000 card, then $5,000 card.

- Using Debt Avalanche, you pay off $5,000 card first, then $3,000, then $2,000 loan.

Debt Avalanche will typically save you hundreds or even thousands of dollars in interest payments and reduce the payoff timeline by several months.

Hybrid Approach: The Best of Both Worlds?

Some financial advisors suggest a hybrid approach, combining elements of both:

- Use the Debt Snowball to gain initial momentum by paying off one or two small debts.

- Then switch to Debt Avalanche to save money on remaining high-interest balances.

This way, you get psychological benefits early on and financial savings later.

Steps to Implement Your Chosen Method

Step 1: List Your Debts

Make a complete list of your debts with balances, minimum payments, and interest rates.

Step 2: Choose Your Strategy

Decide if you want to start with Snowball (smallest debt first) or Avalanche (highest interest first).

Step 3: Budget for Extra Payments

Calculate how much extra money you can allocate monthly toward debt repayment beyond minimum payments.

Step 4: Make Payments

- Pay minimums on all debts except the target debt.

- Put all extra funds toward the target debt.

- Once paid off, move to the next debt on your list.

Step 5: Track Progress and Adjust

Monitor your progress monthly, celebrate wins, and adjust your budget if needed.

Common Mistakes to Avoid

- Ignoring your budget: Make sure your repayment plan is realistic.

- Neglecting emergency savings: Avoid draining your savings entirely; keep a small cushion.

- Adding new debt: Avoid accumulating more debt during repayment.

- Getting discouraged: Progress may seem slow at times—stick with it.

Additional Tips to Accelerate Debt Repayment

- Cut expenses: Redirect savings to debt.

- Increase income: Take side gigs or overtime.

- Negotiate lower interest rates: Call creditors to ask for lower rates.

- Use windfalls: Tax refunds, bonuses, or gifts can help.

- Consolidate or refinance: Consider a lower interest loan or balance transfer.

Tools and Resources to Help You Pay Off Debt

- Debt Snowball Calculator – NerdWallet

- Debt Avalanche Calculator – Bankrate

- You Need A Budget (YNAB)

- Dave Ramsey’s Debt Snowball Method

- Mint Budgeting App

Final Verdict: Debt Snowball vs. Debt Avalanche — Which Should You Choose?

There’s no one-size-fits-all answer. Both strategies have pros and cons:

- If motivation is your biggest hurdle, and you want quick psychological wins, Debt Snowball is a great choice.

- If saving the most money in interest and paying off debt faster are your priorities, Debt Avalanche is more effective.

- Consider a hybrid approach if you want motivation early and savings later.

Remember, the best repayment method is the one you will stick with consistently.

Debt can feel like a heavy burden, but with a plan in place, you can regain control, reduce stress, and improve your financial future. Choose a method, stick to your budget, and celebrate each debt you pay off—you’re building a stronger financial foundation one payment at a time.

🎁 Want a Surprise?

Click here to get redirected to a random post